DECC adopted the feed-in-tariff to encourage micro-generation and help meet the government's twin targets of 15% electricity generation from renewables and a 34% reduction in greenhouse gas emissions, both by 2020. With renewables at only 3% of electricity generation in 2009, the government needed to take drastic action. A brief (and mostly painless) foray into economic theory shows why. Solar photovoltaic (PV) systems get most of the attention, so we'll use those for our example.

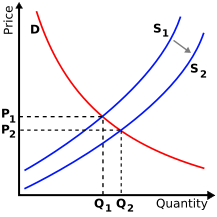

The chart below shows an idealized supply-demand curve:

At historic prices for PV systems (P1), there is only limited customer appetite for domestic and commercial PV installations. To dramatically increase adoption, government would have to either increase customers' willingness and ability to pay (shifting the demand curve), or reduce the cost of the system by shifting the supply curve. Price controls and explicit industry handouts are a tricky feat for a government committed to free market mechanisms (more on that below), so DECC opted to shfit the demand curve, say from D1 to D2 in the illustration above. That would shift sales from Q1 to Q2.

DECC wanted the initial feed in tariff to drive a significant increase in adoption, so they set it at 43.1 pence per kilowatt-hour of electrical production for small scale PV systems. At a time when the carbon markets were paying around €15 per tonne for greenhouse gas reduction measures, DECC offered households and businesses the equivalent of €700 per tonne.

And did that demand curve ever shift! In 2009, there was only 26.5 megawatts (MW) of installed PV capacity in the United Kingdom. By the end of 2010 that number had nearly trebled to 76.9 MW.

Then something interesting happened. The supply curve shifted, too, and by even more. The Chinese government provided highly subsidised loans to encourage solar manufacturing. As a result, low-cost production soared as new solar panel manufacturers flooded the market - in many cases driving producers in the U.S. and other countries out of business. The supply curve shift - from (S1) to (S2) in the illustration below - meant that the average global cost of PV panels dropped from around US $4 per watt to just over $1 per watt in 2011. Only some of this decrease was passed on to consumers - in the UK the cost of PV systems have fallen by about one-third, but even this could mean a saving of thousands of pounds.

Now, not only did customers have more money with which to purchase PV systems, but prices were falling at the same time. As a result demand skyrocketed. Between January and December 2011, installed PV capacity in the UK had jumped nearly ten-fold from 76.9 MW to 750 MW.

This huge increase in PV installations means a relatively huge feed-in-tariff bill for government and electricity rate-payers. Thus the push to gradually roll back the feed-in tariff, from 43.1 down to 21 pence, and ultimately to 11 pence per kilowatt-hour.

While the costs for the feed-in tariff are dwarfed by other expenditures from petrol to defense to healthcare, they are large enough to spark a debate about the appropriate level of subsidy for renewables in the UK. The costs of the feed-in tariff are obvious enough: money paid for renewables-based electricity generation comes at the expense of other items, and if the scheme is designed poorly, it might come at the expense of basic necessities for more vulnerable members of society.

The benefits are no less real, but are not always as obvious. There are the long term financial savings by companies and households that have installed renewable energy systems, the contribution these installations make towards less volatile fuel and power costs, the job creation effects associated with relatively labour-intensive system installation, and of course the contribution to the fight against global climate change.

DECC is hoping that the supply curve for renewables continues to shift to the right, enabling customers to continue installing these systems without further resort to taxpayer or ratepayer subsidy. So far it is too soon to tell, but the Carbon Clear team will be watching to see how this market develops.